Revenue Recognition / Accrual Accounting

If you want to run accrual accounting treatment from Stripe to QuickBooks, Acodei currently has limited functionality to help.

QuickBooks Online Advanced Solution

The best option currently is using the QuickBooks Online Advanced Revenue Recognition feature, explained here.

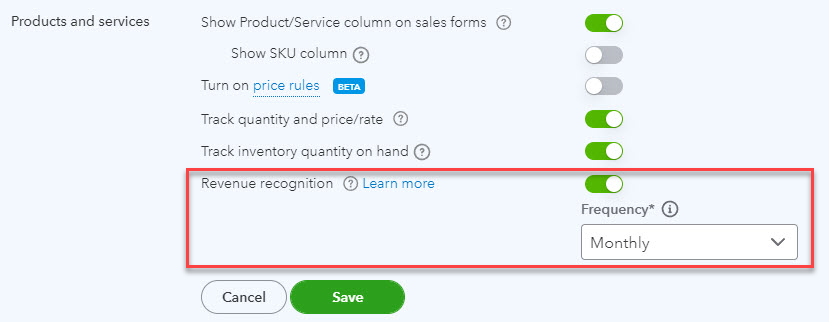

Turn on Revenue Recognition by visiting QuickBooks Online Account and Settings, then Sales, then Products and Services, shown here:

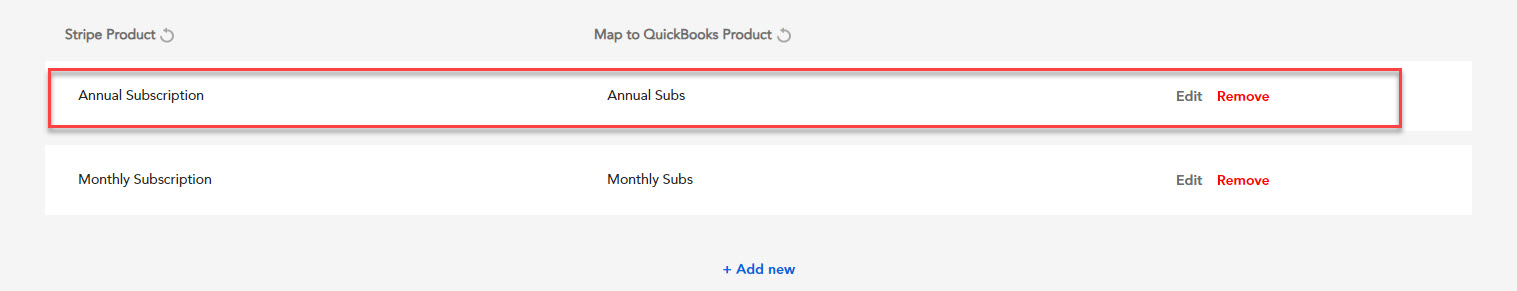

This feature works in conjunction with Acodei's Multiple Product Mapping feature.

For example, if you have a Monthly subscription product and an Annual subscription product, and you want to track deferred revenue on Annual subscriptions, your setup would look like this inside Acodei, using product mapping:

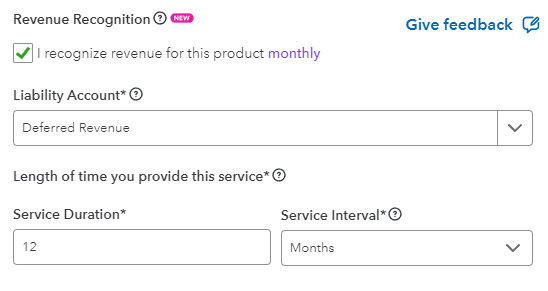

For the "Annual Subs" QuickBooks product, you would apply Revenue Recognition:

Using this process, QuickBooks will create journal entries on your behalf over the course of 12 months, recognizing the revenue from that sale.

Stripe Revenue Recognition

Stripe offers a Revenue Recognition service that is GAAP-compliant and highly advanced. Due to its high complexity, we do not currently recommend Stripe Revenue Recognition for most startups and small businesses. However, we continue to work with the Stripe team to make the data more accessible and integrate it more fully in the future.

Acodei does not support accrual accounting beyond the explanation above, but we are working on features and are looking for customers who want to actively test and give feedback on revenue recognition and accrual accounting features.

If you're interested in working with us on building new features to support your accrual accounting workflows, please message us at support@acodei.com.