Stripe Capital

Stripe Capital is a financial service offered by Stripe. It provides business loans based on transaction history, with repayment automated through a percentage of future sales. It helps businesses access capital quickly and supports their growth by leveraging sales data. Acodei supports Stripe Capital.

On this page, we provide the steps to add Stripe Capital to Acodei.

-

Create a product for Stripe Capital: First, you must create a product (for use in payouts and daily balance summaries). You will likely link this product to a liability account.

-

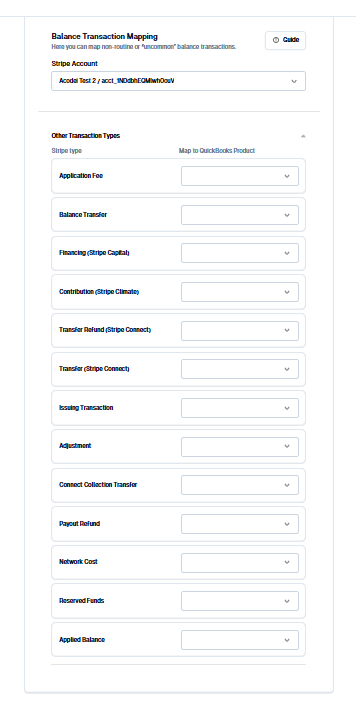

Add the product to Balance Transaction Mapping: Once we detect Stripe Capital or any other uncommon transaction type on your account, you will be able to map Financing (Stripe Capital), as presented in the following image. This page is accessed on the Account Mapping Page under Balance Transaction Mapping (if this isn’t showing, click on Customize in the top right and toggle Balance Transaction Mapping on).

- Save your changes: Save your changes, and Acodei will then process financing transactions on the daily balance summary or upon payout based on your preferences. Check your liability account to ensure the balance is changing correctly.

Stripe Capital Accounting Adjustments

Stripe Capital does not provide Acodei with detailed data about what part of the payment is going toward your principal payment vs your fixed fee. As a result, you should add a monthly, quarterly, or annual adjustment to account for Stripe Capital fees.

Since Stripe Capital feeds data into a Liability account, you will want to create a journal entry. Debit your liability account and credit your expense (interest or fee expense) account for the amount of the fee. If we start receiving fee and principal data, we will make a future update to this feature.

Fixing an unsynced payout

Once you have followed the steps above, you can visit the Payouts tab in the Data Feed. If a payout is not synced because of a Stripe Capital error, you can resync the Deposit.