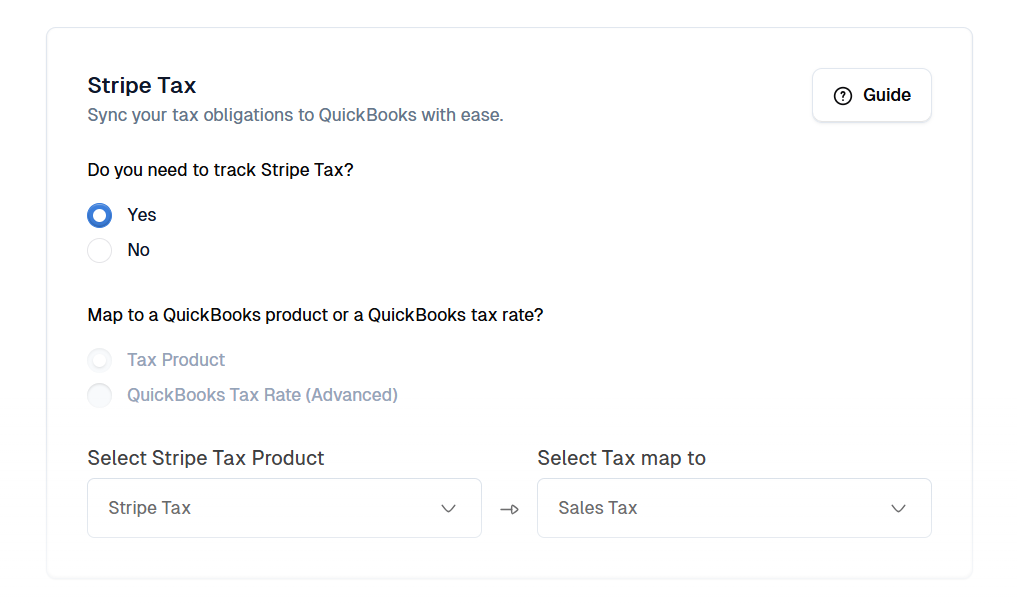

Stripe Tax

Acodei integrates with Stripe Tax to keep your QuickBooks sales tax records accurate. With Stripe Tax enabled, Acodei will automatically sync calculated taxes from Stripe into QuickBooks so you can easily track what you’ve collected and stay compliant.

How Stripe Tax Works

Acodei supports two ways of syncing Stripe Tax into QuickBooks:

-

Tax Product (Simple Method)

-

Best for U.S.-based QuickBooks accounts.

-

All taxes are grouped into one product (e.g., “Sales Tax”) tied to a liability account in QuickBooks.

-

Use Stripe’s own reports to see detailed state/county breakdowns when filing.

-

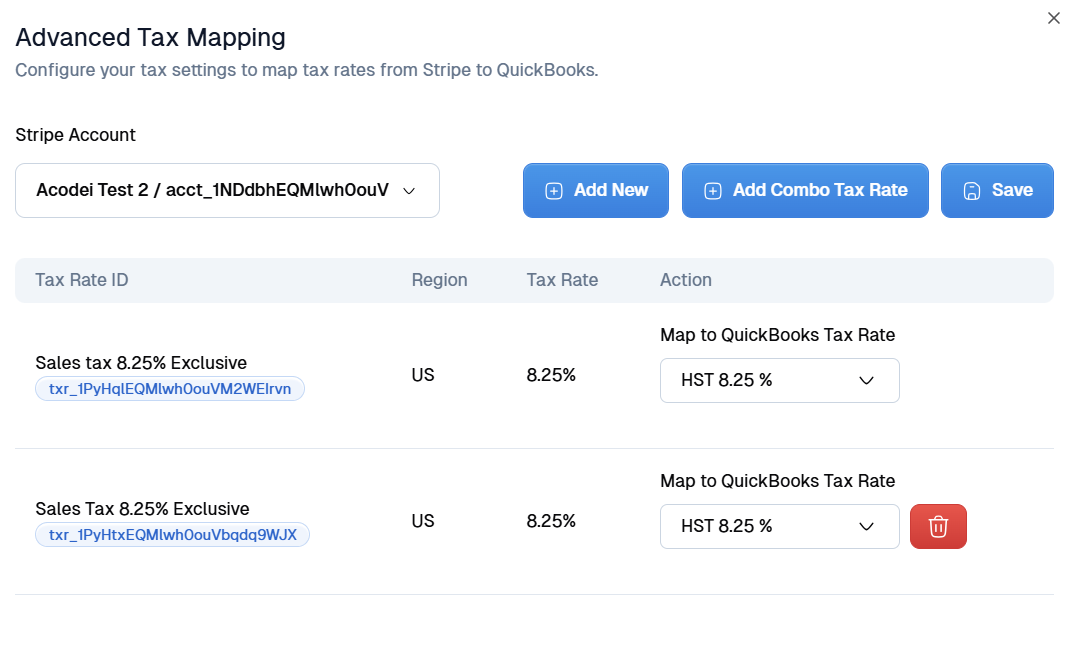

QuickBooks Tax Rate Mapping (Advanced Method)

-

Available for non-U.S. QuickBooks accounts.

-

Each Stripe Tax Rate (e.g., VAT, GST) can be mapped to the correct QuickBooks tax code.

-

Supports multiple taxes on the same line item (e.g., GST + PST mapped to a QuickBooks group tax).

Note: U.S. QuickBooks accounts are limited by Intuit’s rules and can only use the Tax Product method. Non-U.S. accounts may use either option. If you are a U.S.-based company seeking more precise tax entries in QuickBooks, please contact us.

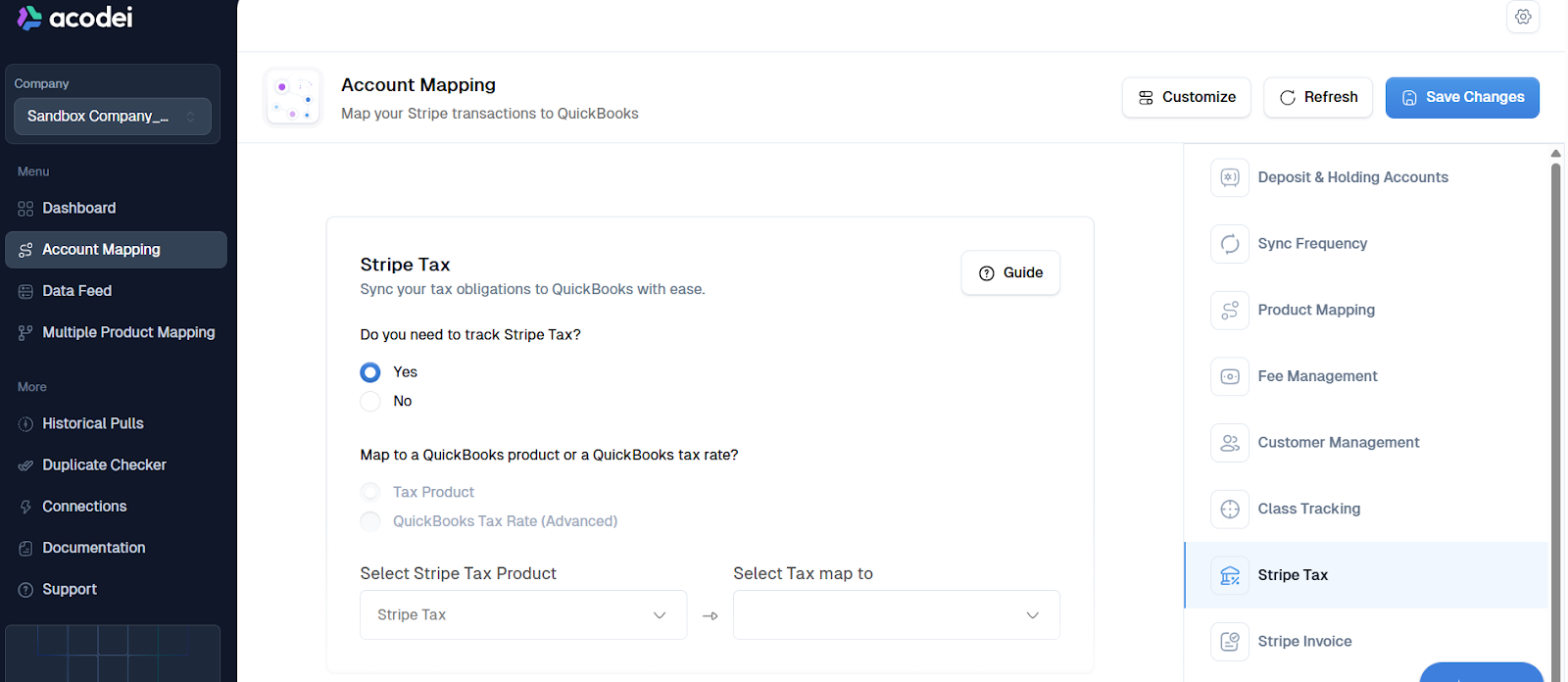

Setup Instructions

-

Log into your Acodei Dashboard.

-

Open the Account Mapping module.

-

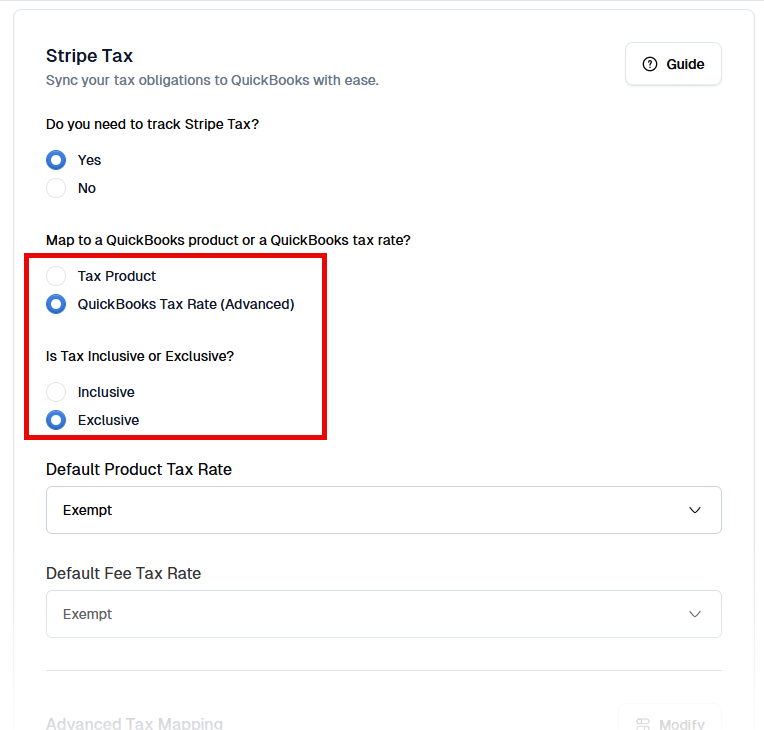

Scroll down to the Stripe Tax section.

-

Toggle Yes to enable Stripe Tax.

-

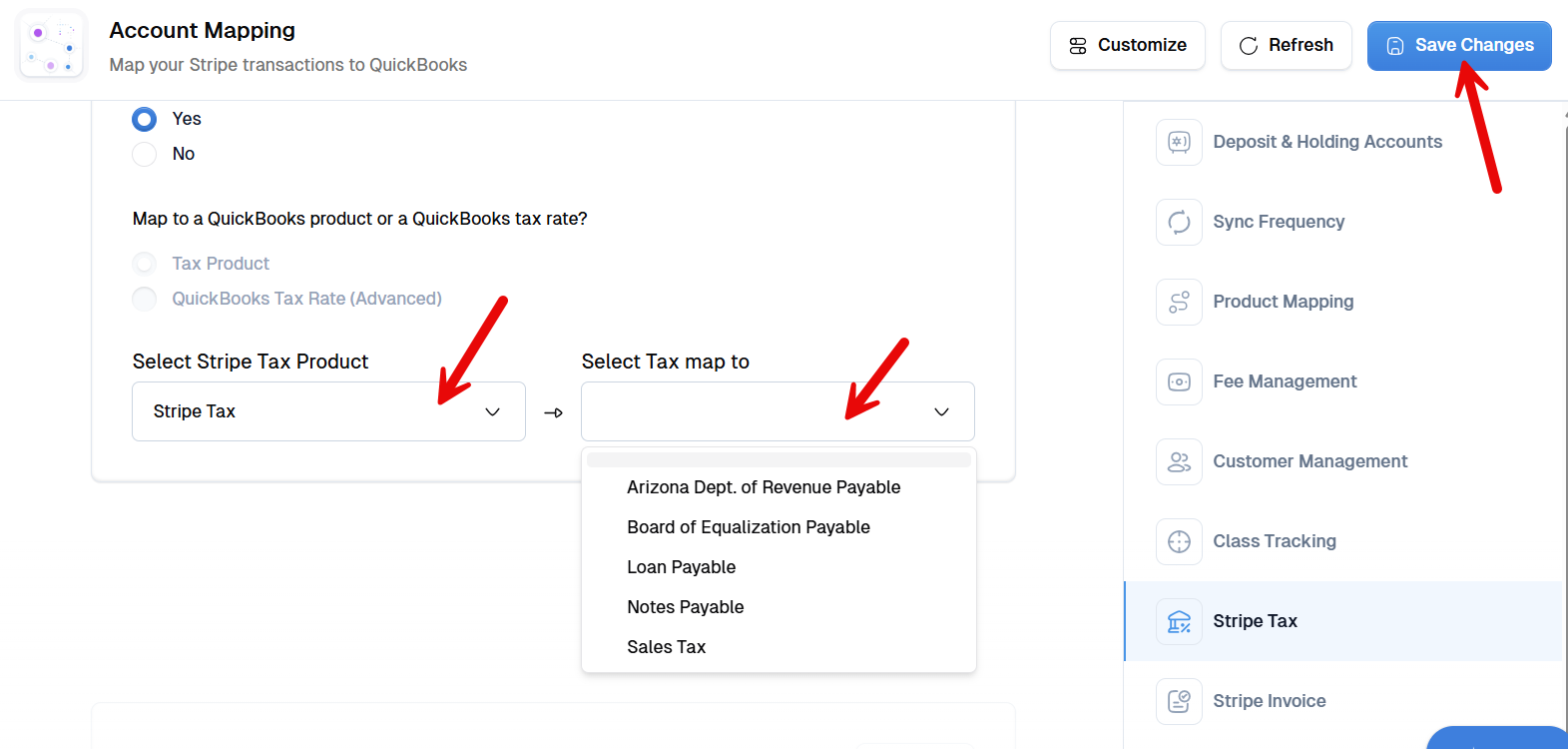

Choose your method for syncing tax into QuickBooks:

A. Tax Product (Simple Method)-

Create or select a non-inventory product in QuickBooks (e.g., “Sales Tax”) tied to a liability account.

-

In Acodei, select this product so all Stripe Tax amounts are rolled into one line item in QuickBooks.

-

-

- Click Save Changes

- First, choose whether your tax is:

-

Inclusive → Tax is already included in the item’s price. Acodei adjusts QuickBooks so totals match Stripe.

-

Exclusive → Tax is added on top of the item’s price.

- Select your Default Tax Product Rate and Default Tax Fee Rate:

-

These act as fallback tax rates for unmapped cases.

-

Typically, set both defaults to Exempt, unless you want a specific rate applied when no Stripe Tax mapping exists.

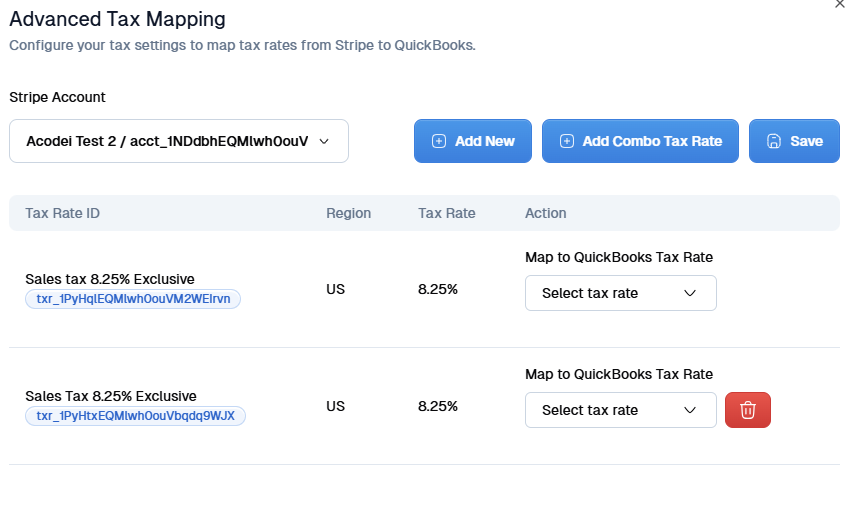

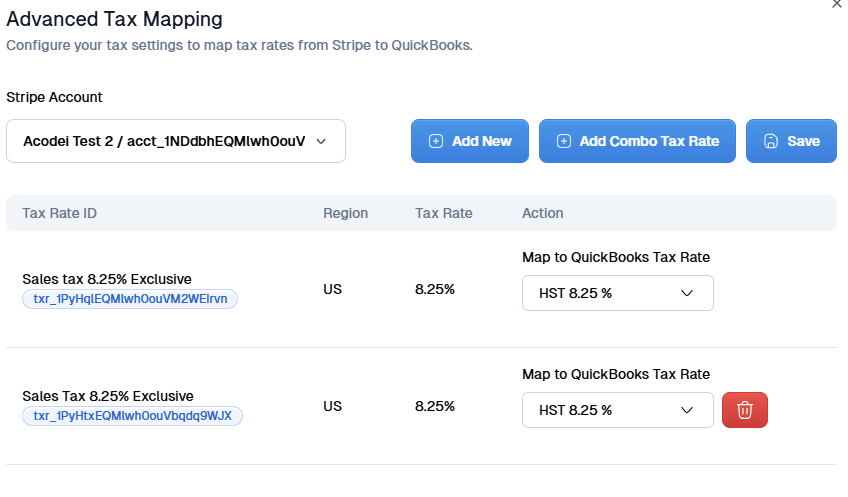

- Acodei will pull in all Stripe Tax Rates from your Stripe account (e.g., VAT 20%, GST 5%).

- For each Stripe Tax Rate, select the matching QuickBooks tax code from the dropdown (e.g., Stripe “VAT 20%” → QBO “VAT 20%”).

-

If multiple Stripe Tax Rates apply to a single line item (e.g., GST + PST), select them together and map them to a QuickBooks group tax code.

-

Click Submit Changes to save your setup.

Refunds

-

Credit Note Refunds (Recommended) → Tax is properly adjusted in QuickBooks.

-

Payment-Only Refunds → Stripe doesn’t always provide line-level detail, so tax may need manual adjustment.

Please email support@acodei.caom if you need additional help with tax refunds.

See our guide on handling incorrect refunds.

Daily Summary vs. Real-Time Sync

-

Daily Summary → Combines all transactions from the day into one QuickBooks entry, with tax amounts split by product + tax rate.

-

Real-Time Sync → Each invoice or payment syncs individually, with full tax detail.